The Giving Season is here, and if you’ve been thinking about supporting Ukraine, now’s the perfect time to do it smartly and tax-efficiently.

As a registered 501(c)(3) nonprofit organization in the United States, all donations to Dignitas Ukraine are tax-deductible under U.S. law. That means your generosity not only helps save lives but can also reduce your taxable income.

Here are ten powerful, tax-smart ways you can give.

1. Direct Donations (Credit Card, PayPal, Bank or Check)

Making a direct donation is the simplest and most popular way to support Ukraine – and it’s 100% tax-deductible.

How it works:

- Donate online through our secure website or PayPal.

- Send a bank transfer if you prefer.

- Or mail a check payable to Dignitas Ukraine: PO Box 233 Cranford, NJ 07016.

How it helps:

Your contribution immediately funds life-saving technology, training and humanitarian aid – from drones that protect communities to mobile bath-laundry units that bring hygiene and relief to the front line.

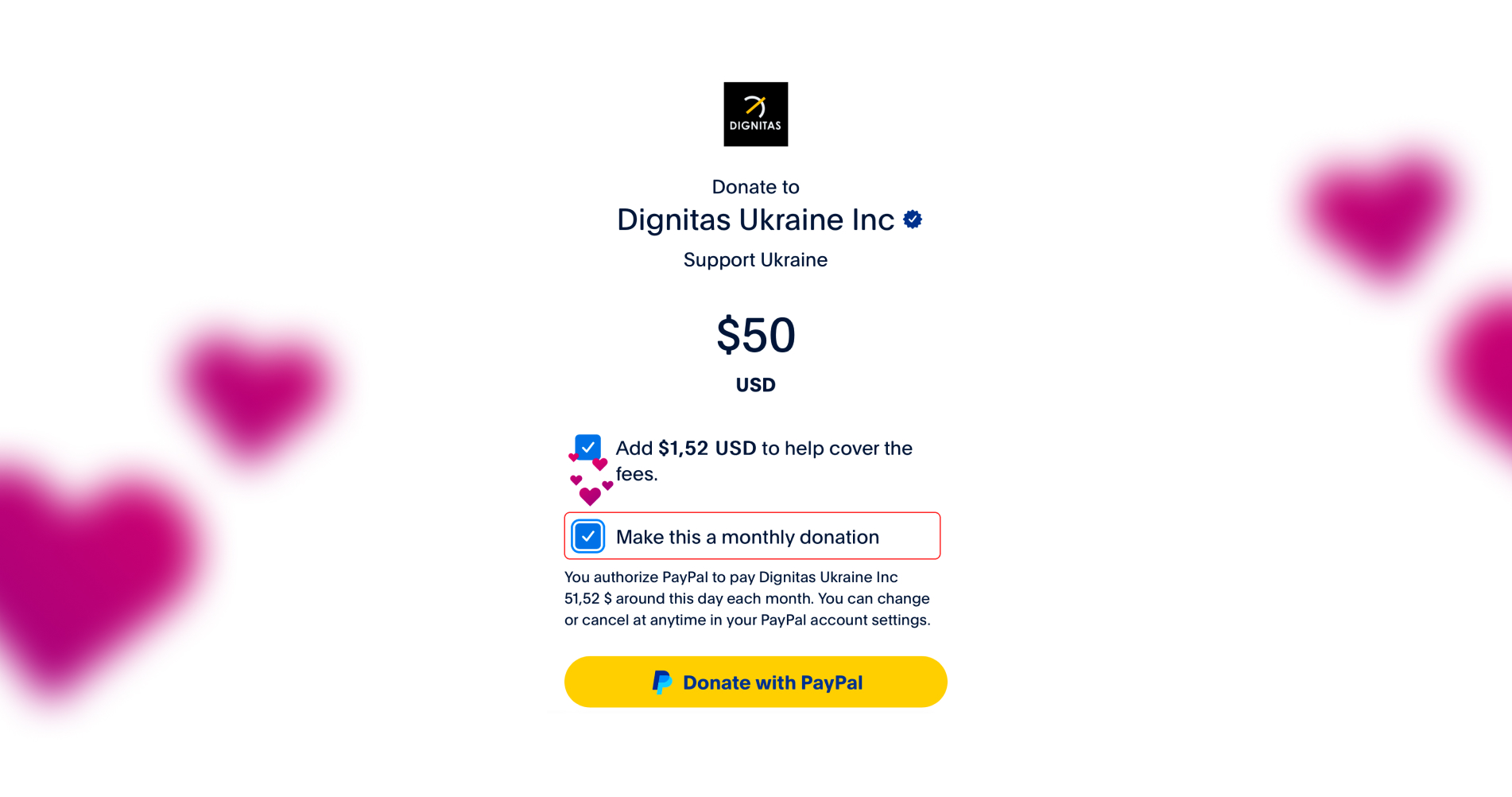

2. PayPal Giving Fund

Want to give quickly and securely and with no fees? The PayPal Giving Fund lets you donate to Dignitas Ukraine through PayPal’s verified charity system.

How it works:

You donate through the PayPal Giving Fund, receive a tax receipt from PayPal, and 100% of your gift (no transaction fees) is passed directly to Dignitas Ukraine.

Why it’s smart:

You get full tax deductibility and the assurance, knowing every cent goes to where it’s needed most.

3. Amazon Wishlist

Every item on our Amazon Wishlist has been requested by Ukrainian defenders: drones, tablets, batteries, and other vital tools.

How it works:

- Choose and purchase an item.

- Amazon ships it directly to Dignitas Ukraine.

- We use it immediately in the field or training centers.

Why it’s smart:

It’s a tangible way to see your impact – a form of in-kind donation, where you give goods instead of money.

You’ll receive an acknowledgment receipt by email from Dignitas Ukraine for your tax records.

4. Employer Donation Matching

Did you know your employer may match or even triple your donation to Dignitas Ukraine?

Many U.S. companies will match – or even triple – donations made to 501(c)(3) nonprofits. It’s one of the easiest ways to multiply your impact without spending a dollar more.

How it works:

- Check if your employer participates using our quick and easy matching tool

- Submit your donation receipt through your company’s portal or HR department.

- Your company sends an additional donation directly to Dignitas Ukraine.

Why it’s smart:

You double your impact helping deliver twice as many drones, tools and relief programs for defenders and civilians.

5. Donor-Advised Funds (DAFs)

If you have a Donor-Advised Fund with Fidelity, Schwab, Vanguard, Benevity or another provider, you can recommend a grant to Dignitas Ukraine directly.

How it works:

- Log in to your DAF portal.

- Search for Dignitas Ukraine – EIN: 92-3194330.

- Submit your grant recommendation.

Why it’s smart:

Your contribution is immediately tax-deductible when you donate to your DAF and you can decide later when and how to support causes like Dignitas Ukraine.

6. Stock Donations

Donating appreciated stock is one of the most tax-efficient ways to give.

How it works:

Instead of selling your shares, you can transfer them directly to Dignitas Ukraine. You’ll avoid capital gains tax and can deduct the full fair market value of your stock on the date of donation.

Why it’s smart:

You give more while saving on taxes helping bring life-saving technology, training, and humanitarian aid to those defending Ukraine.

Want to learn more about how stock donations work?

Read our article Stock Market Rally: The Perfect Time to Give Stocks for a full guide on maximizing your impact.

7. Cryptocurrency (BTC & ETH)

Crypto giving is fast, secure, and tax-smart and Dignitas Ukraine accepts both Bitcoin (BTC) and Ethereum (ETH) directly.

How it works:

Our BTC and ETH wallet addresses:

- BTC (Bitcoin) – bc1qvgxgjvgr42arm0r0umnm4wpvz6fjkq53h78qfh

- ETH (Ethereum) – 0xBd08a9427C6E6b68a75E8845cFd47E60504AbE44

To donate, simply:

- Copy the BTC or ETH address.

- Open your own wallet or exchange account.

- Choose “Send,” paste the address, enter the amount, and confirm the transaction.

Why it’s smart:

By donating crypto directly, you avoid capital gains taxes and can deduct the fair market value, turning digital assets into real, life-saving impact in Ukraine.

8. Merch

When you purchase our make russia small again apparel or Vyshedronivka t-shirts, you’re doing both: saving lives by supporting Ukrainian defenders and showing your support to others.

How?

Our t-shirts and hoodies do more than raise funds – they help you advocate for Ukraine wherever you are, sparking conversations and spreading awareness every time you wear them.

9. Zelle and Venmo

Prefer quick and familiar ways to give? You can donate directly through Zelle or Venmo – both are secure and tax-deductible.

How it works:

- Open your Zelle or Venmo app.

- Send your gift using the details listed on our donation page.

10. Planned Giving & IRA Contributions

You can support Ukraine’s long-term recovery by leaving a legacy gift in your will, trust, or IRA.

For donors aged 70.5 and older, a Qualified Charitable Distribution (QCD) from your IRA is a tax-free way to give, even if you don’t itemize deductions.

Why it’s smart:

You leave a lasting legacy while receiving valuable tax benefits – ensuring that your commitment to freedom and innovation continues for generations.

Your generosity saves lives

Every tax-deductible donation – whether through a company match, DAF, or Amazon purchase – helps deliver the tools and training that protect Ukrainian defenders and civilians.

Support innovation that saves lives. Give smarter today.