The stock market is unpredictable, and right now it’s at a historic high. With the stock market rally driving prices to record levels, there’s never been a better time to donate some of your wealth to the critical initiatives that we drive at Dignitas Ukraine, while enjoying incredible tax advantages.

When you donate appreciated stock, you unlock benefits for both you and us:

For Donors

- Avoid paying capital gains tax on stocks, bonds, ETFs, etc.

- Deduct the full market value of your donation on your tax return.

For Nonprofits

- Receive larger pre-tax gifts compared to after-tax cash donations.

Why Your Gift Matters

By donating stock or other appreciated securities, you not only save on taxes. Your gift will save lives, build hope, and ensure essential resources for Ukrainians, who risk everything for their (and our) freedom and safety.

Ready to give back with stock donations?

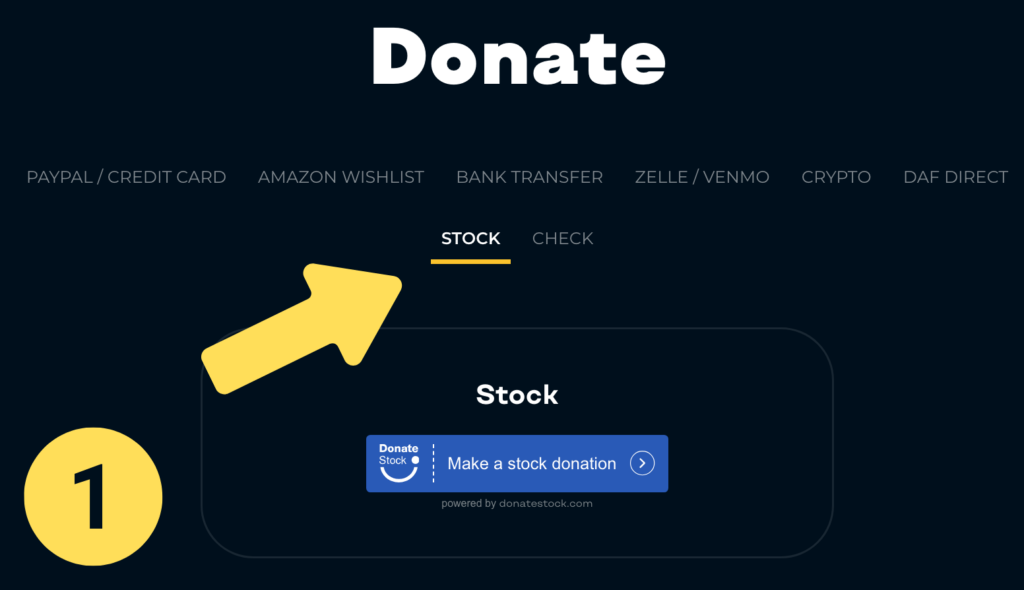

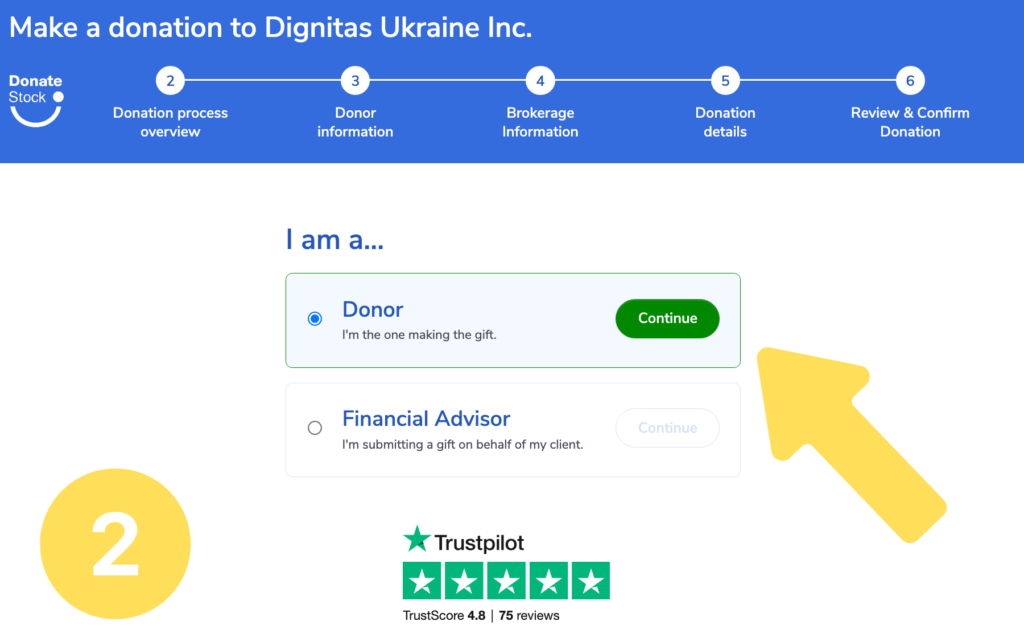

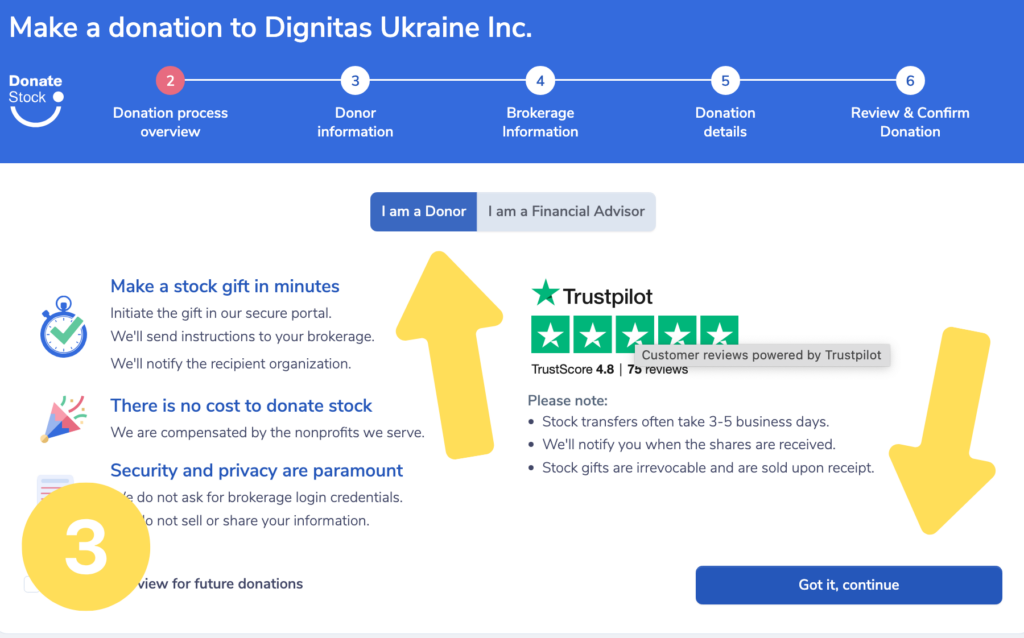

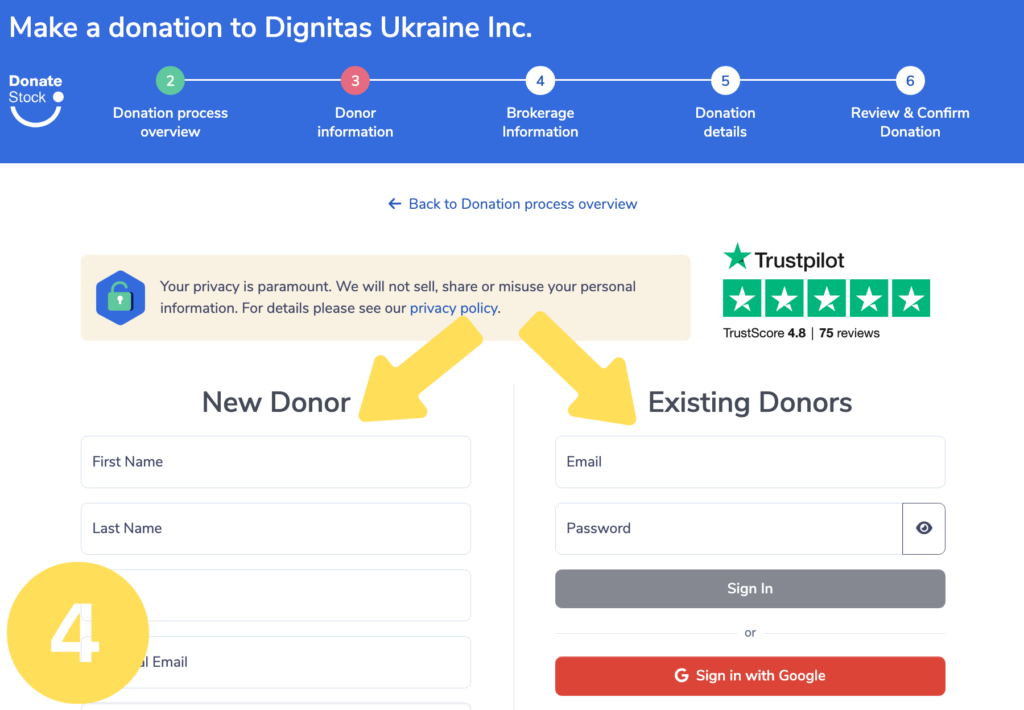

Discover how easy it is to make an impact with our simple guide below, using DonateStock.

After logging in, simply follow the prompts to complete your donation.

Stock Donation FAQs

How long does it take to donate stock?

The time it takes for the stock to transfer over to us varies by brokerage but is typically fast and simple, usually completed within 5-7 business days.

Do I need to donate all of my stock holdings?

You can donate as much or as little stock as you’re comfortable with. Even a partial donation can make a significant difference, helping to support Dignitas’ life-saving programs.

What if I’ve never donated stocks before?

Don’t worry — donating stock is easier than you think! Your brokerage firm can help you with the transfer, and Dignitas provides step-by-step guidance to ensure everything goes smoothly.

Let’s turn generosity into change — together.